Advertisement

The Nation

Business

Advertisement

Inside Nigeria

Sport

Advertisement

Petrobarometer

Company Analysis

Advertisement

Exclusives & Features

Policy Radar

Advertisement

Development Cable

Advertisement

FACT CHECK

CHECK AM FOR WAZOBIA

Viewpoint

Joshua Ocheja

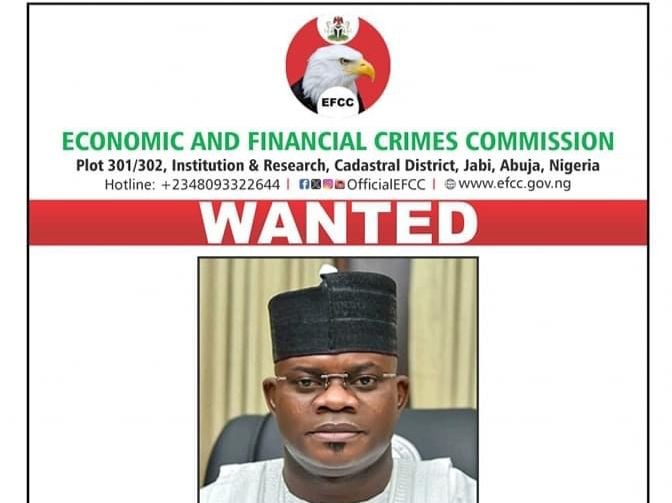

Yahaya Bello: The transience of power

View all articles

Louis Odion

Bouquet for the amazon of multi-tasking at 60

View all articles

Azu Ishiekwene

Is a Third World War coming?

View all articles

Ikemesit Effiong

The imperative of upholding Nigeria’s telecoms lifeline

View all articles

Femi Owolabi

‘BAO, go and learn how to walk like a governor!’

View all articles

Okoh Aihe

For Ben and Jerry, simply tech will go on

View all articles

Reuben Abati

The Yoruba Nation “secessionists” of Ibadan

View all articles

Iliyasu Gadu

Statesmanship not brinkmanship needed in middle east now

View all articles

Etim Etim

Price war in our skies

View all articles

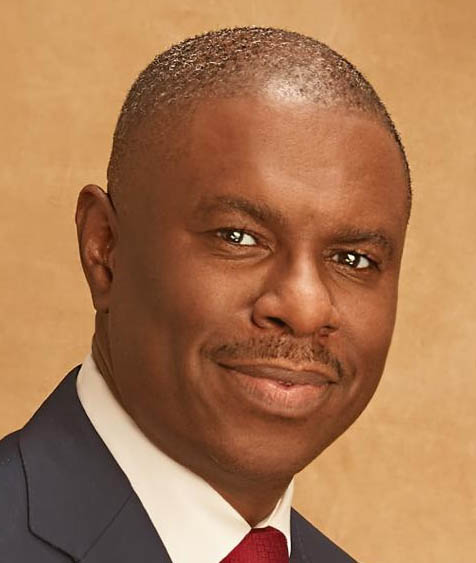

Dakuku Peterside

Air Peace, capitalism, and national interest

View all articles

Your say

Advertisement

Must See Videos

Advertisement